Is Google’s Moat Cracking Under AI Pressure?

For over two decades, Google has been the undisputed gatekeeper of the internet. Search dominance fueled its empire, advertising dollars flowed endlessly, and its control over platforms like Chrome, Android, and YouTube made it an unshakable giant.

But today, long-term investors face a new kind of question: With Alphabet (GOOGL) trading at a lower valuation than many of its Magnificent Seven peers, is this a rare buying opportunity—or a value trap in the making? The stock looks attractive on the surface—massive cash flows, dominant products, global scale—but the real issue for long-term investors is deeper: Is Google’s core moat in search weakening?

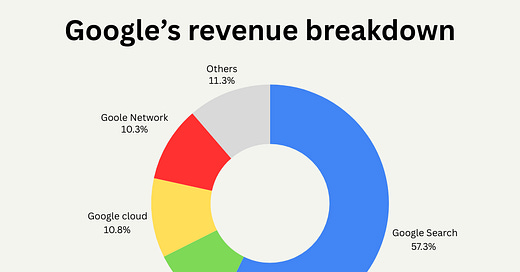

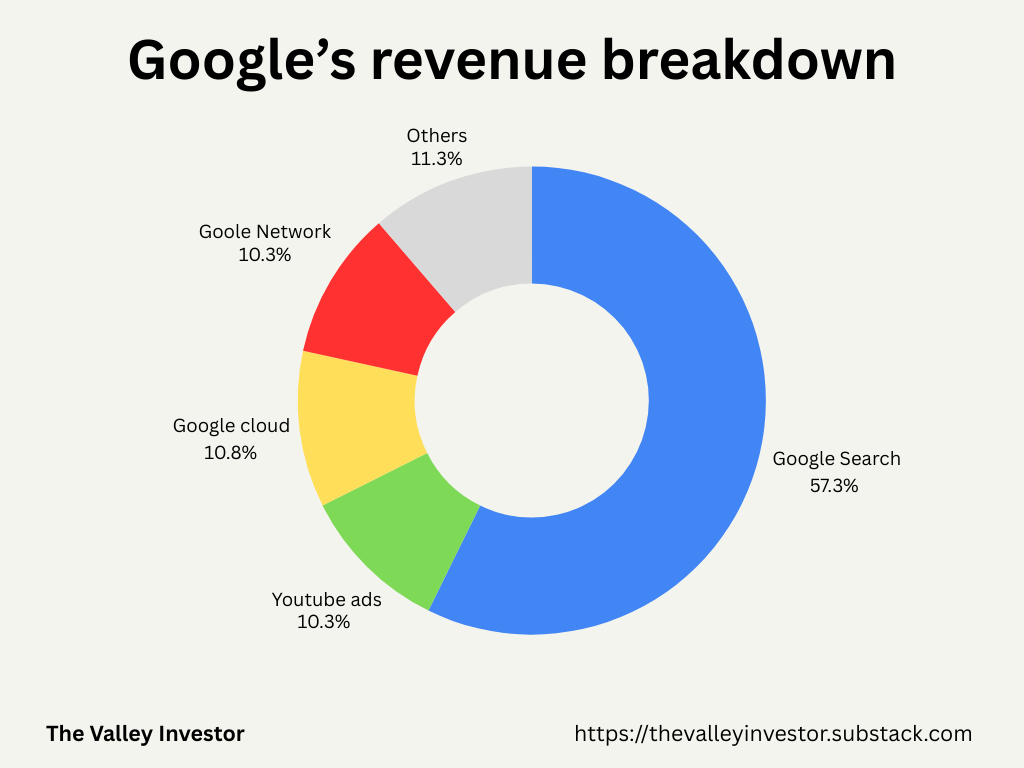

This isn’t just another tech cycle like mobile or social media. AI represents a fundamental shift in how people seek information, bypassing the blue links and ad-driven model that Google has perfected for years. If AI search becomes the dominant interface for information retrieval, then Google’s core business—its ~$200 billion search advertising machine—faces an existential threat.

So, should we jump in and buy Google at this discount? Or is the moat that once made it a no-brainer starting to show real cracks?

To answer that, we need to examine Google’s moat—layer by layer—and evaluate what’s happening to its moat in the AI age.

The Core Threat – AI is Changing Search

The rise of AI-powered search engines like ChatGPT, Perplexity, and Anthropic’s Claude is shifting how users interact with the internet. Instead of querying Google and clicking a result, AI models now deliver synthesized, conversational responses in seconds—without needing to show 10 blue links or serve ads.

This shift is real. While exact numbers vary, ChatGPT now receives nearly 4 billion monthly visits, and Perplexity has crossed 275 million monthly visits, showing early signs of behavioral change. Google’s own internal data, revealed during antitrust hearings, indicated that nearly 40% of young users prefer TikTok or Instagram for discovery-based searches over Search. These aren’t marginal shifts—they signal an emerging behavioral change that could accelerate over time.

Yet, Google Search usage remains at record highs—over 5 trillion queries annually, with continued year-over-year growth. Google still holds over 90% global search engine market share as of early 2025.

So, how do we reconcile these two facts?

The answer is that not all searches are created equal. AI-powered search isn’t replacing all Google queries. It is, however, chipping away at the most valuable ones—high-intent searches like product recommendations, travel planning, research, and coding help. These are precisely the searches that fuel Google’s ad business.

For Google, traffic volume itself isn’t the issue. It’s the quality of monetizable traffic that is at risk. If AI-based tools capture high-intent searches, ad budgets could shift away from Google over time.

Google’s Counterattack – AI Overviews and AI Ads

Google is not blind to this disruption. Its response has been to integrate AI into Search itself. The company has rolled out AI Overviews (SGE – Search Generative Experience) to generate AI-powered summaries within Google Search results. This is meant to counteract the threat of AI search assistants while keeping users within Google’s ecosystem.

But here’s the problem: AI Overviews are cannibalizing Google’s own ad model. When AI-generated responses appear, organic click-through rates drop by up to 70%, and paid ad CTR declines by around 12 percentage points.

This presents a paradox. If Google aggressively integrates AI into Search, it risks reducing the effectiveness of its own advertising business. If it doesn’t, users may migrate to AI-driven alternatives that answer questions better.

The company is testing AI-driven ad formats embedded within AI Overviews to counteract this. But monetizing AI-driven search remains an unsolved problem. Unlike traditional search, where an ad simply appears alongside organic results, AI-generated responses need to be carefully balanced to avoid ruining user trust while still making money.

If AI search models lower Google’s monetization per search, then even stable search volume won’t be enough to sustain long-term growth.

The Regulatory Risk – Could Google Be Forced to Change?

Beyond AI disruption, regulators are circling Google’s business model. The U.S. DOJ’s antitrust case is already targeting Google’s dominance in search. Google paid Apple $20 billion in 2022 to remain the default search engine on iPhones—a deal that regulators may seek to block. Testimony also revealed that this deal drives nearly 50% of Google’s mobile search traffic.

The EU’s Digital Markets Act could force Google to unbundle its ad business or alter its search ranking mechanisms. DOJ is also exploring the possibility of requiring Google to divest Chrome, which would be a massive blow to its search traffic funnel.

If Google loses the Apple default search deal or has to sell off Chrome, it risks losing billions in high-intent traffic. If regulators force changes to its ad dominance, Google’s margins could suffer.

YouTube & Cloud – The Safety Nets

While search is under pressure, Google’s other moats—YouTube and Cloud—remain strong. Video consumption continues to grow, and YouTube remains dominant despite TikTok’s rise. Even in an AI-driven world, YouTube has content depth and advertising scale that AI competitors lack.

In Q4 2024, YouTube’s ad revenue rose 14% YoY to $10.47 billion. Meanwhile, Google Cloud grew 30% YoY, reaching $11.95 billion in quarterly revenue, fueled by increasing demand for AI infrastructure and services like Vertex AI.

These segments are not enough to fully offset search’s decline, but they provide a buffer that most competitors lack.

Google’s Moat is Weakening, but Not Collapsing (Yet)

Google is facing the most serious challenge to its search monopoly since its inception. AI-driven search, combined with regulatory pressures, is eroding its strongest revenue stream—search ads.

However, Google’s sheer scale, data advantage, and infrastructure give it time to adapt. Search volume is still massive, and users are not abandoning Google en masse—yet. Google’s AI integration (SGE, Gemini) isn’t perfect, but it buys time while AI search competitors struggle with monetization. YouTube and Cloud provide secondary growth engines that soften search-related declines.

But make no mistake—Google’s dominance is no longer untouchable. AI is cutting into its most profitable searches, regulators are turning up the heat, and the company itself hasn’t fully figured out how to monetize AI-driven search.

Google’s scale, distribution, and ecosystem give it time to adapt—if it executes correctly. The coming 2–3 years will be critical in determining whether Google’s AI pivot is a masterstroke or an unavoidable decline.

So what does it mean for the long-term investors?

For investors, this is no longer the “set it and forget it” Google of the past. The days of effortless dominance are over. Going forward, Google will have to fight for its future—against AI-native challengers, regulatory headwinds, and even the limits of its own business model.

But this doesn't mean Google is no longer investable. Rather, it marks a shift in the nature of the bet.

Long-term investors who own the stock or are considering buying it today must ask:

Can Google successfully defend its high-margin search empire while re-architecting it for the AI era?

Will YouTube and Cloud become meaningfully large profit engines if search growth slows?

Can Google maintain its culture of innovation while monetizing AI in a way that preserves trust and scale?

This is no longer a blind bet on dominance—it’s a bet on execution. For those willing to underwrite that risk at the right price, Google may still be a long-term compounder. But it deserves closer scrutiny than ever before.

Disclaimer: I directly own a small position in Alphabet (GOOGL), but I am not currently adding to that position. This piece is intended for informational purposes only and is not investment advice.

Before you go — I’d love your quick feedback. It helps me improve these posts and make them more useful for you.

Feel free to hit reply with any suggestions or your feedback. What would you like to see more of? Are there other companies or themes you'd like me to cover next? Did anything in this analysis surprise you? I’d love to hear from you!