SoFi Technologies (NASDAQ: SOFI) has gone from a scrappy fintech startup to a full-fledged, profitable financial institution in just a few years. In 2024, it delivered its first full year of GAAP profitability, generating $2.61 billion in revenue (+26% YoY) and $666 million in adjusted EBITDA (26% margin). The company is no longer just a student loan refi player—it’s a digital banking powerhouse with a growing flywheel of lending, banking, investing, and B2B tech services.

But despite the financial momentum, SoFi’s stock remains volatile. After a rollercoaster ride post-SPAC IPO, it currently trades at ~$11–12 per share, with a valuation of ~5x sales and ~2.8x tangible book value. The question is: Does this fintech still have room to grow, or is it priced for perfection? In this brief, we analyze whether SoFi presents an attractive long-term investment opportunity—or if the risks outweigh the rewards. We will dive into:

📌 Business Model – How the company generates revenue

💰 Financial Performance – Key financial metrics and growth trends

🌍 Competition & Industry growth – Market rivals and competitive positioning

🛡️ Moats – Unique advantages protecting the business

👨💼 Management & Execution – Leadership strength and strategy

⚠️ Challenges Going Forward – Key hurdles and obstacles ahead

🚨 Risks – Potential threats and uncertainties

🔭 5-Year Outlook – Future growth and strategic direction

📊 Valuation Analysis – Stock valuation and investment potential

📌 The SoFi Business Model: A Fintech Super App in the Making

SoFi isn’t just a bank, a lender, or an investment platform—it’s all three, rolled into one. The company has built a financial ecosystem designed to acquire customers through lending, then cross-sell them into banking, investing, and beyond.

How SoFi Makes Money:

🔹 Lending – The original business. SoFi issues personal loans, student loan refinancing, and mortgages, making money from interest income and origination fees.

🔹 Financial Services – SoFi Bank offers checking & savings accounts, stock and crypto trading, robo-advisory, and credit cards. The revenue here comes from interchange fees, account fees, and net interest margin.

🔹 Technology Platform – SoFi owns Galileo (a banking/payments API platform) and Technisys (a core banking software provider). These B2B services generate recurring revenue from fintech clients and banks.

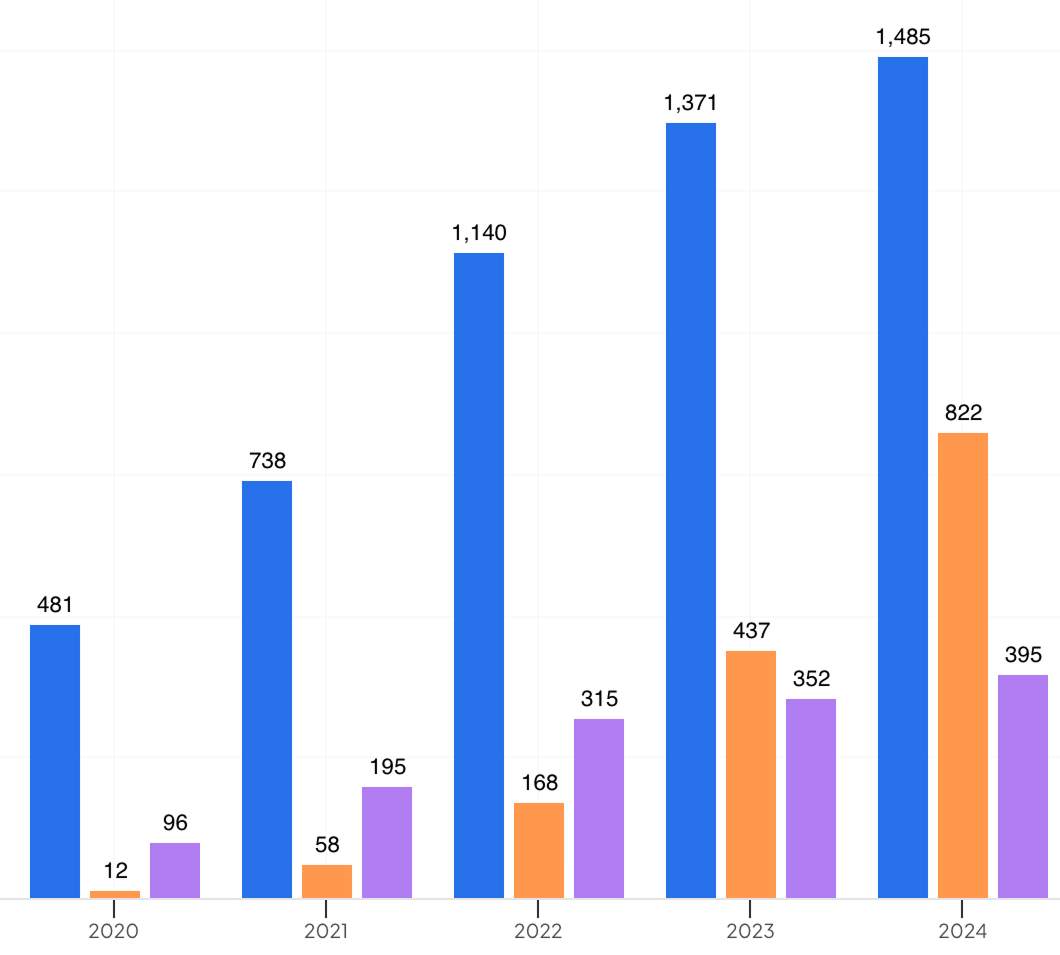

The strategy? The Financial Services Productivity Loop—acquire a customer with a loan, cross-sell them into banking and investing, and drive long-term retention. The bank charter, obtained in 2022, supercharges this model by allowing SoFi to fund loans with its own low-cost deposits (~$25B in deposits today). The company has seen healthy member growth over the years as a result of this strategy.

💰 Financial Performance: A Rapidly Growing, Now-Profitable Fintech (Score: 8/10)

📈 Explosive Growth:

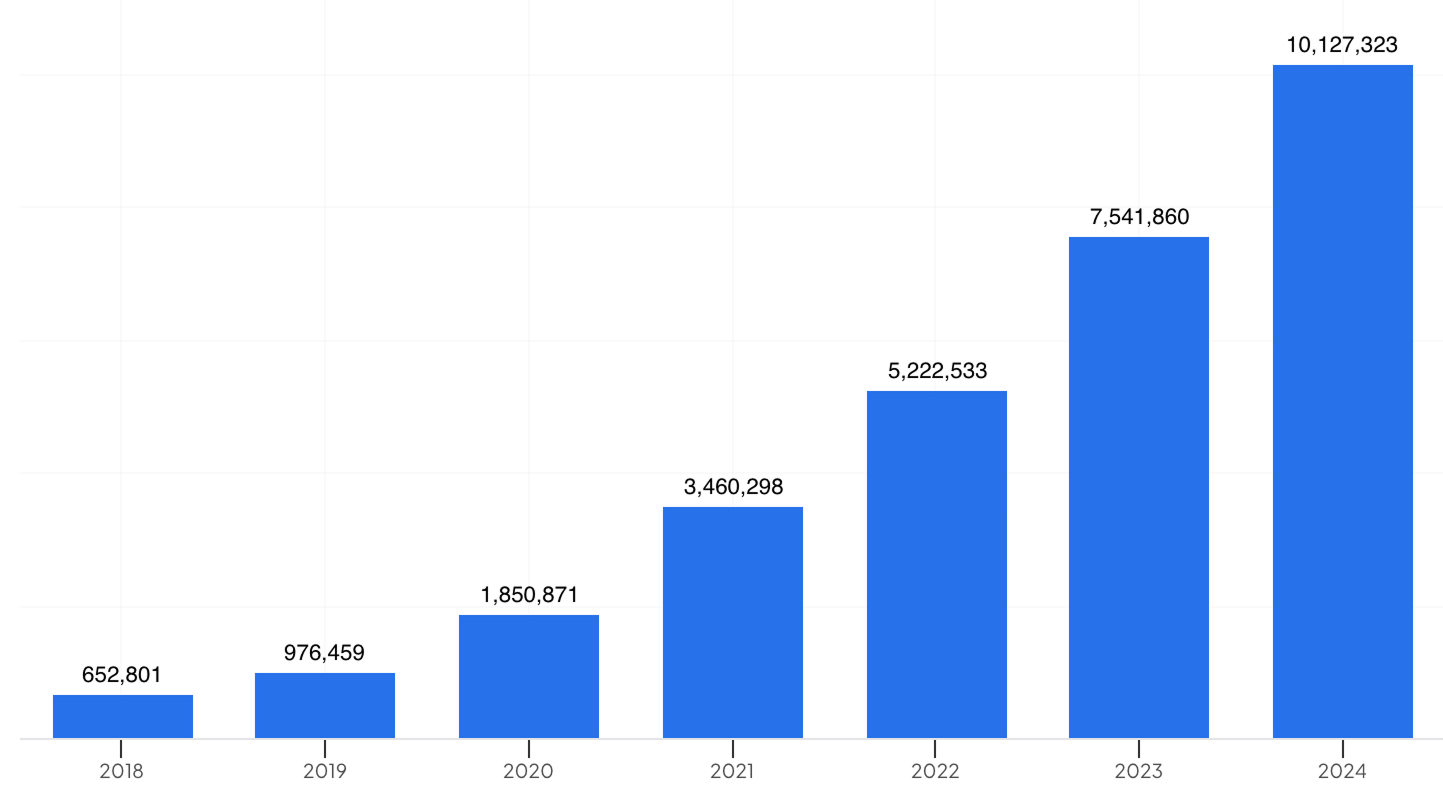

Revenue Growth: Quadrupled from $566M in 2020 to $2.7B in 2024.

Personal Loans: A record-breaking $23.3B in originations in 2024.

Student Loan Refinancing: Rebounded strongly post-moratorium, up 71% YoY in Q4 2024.

Galileo Accounts: Reached 168M in 2024, growing 15% YoY, showing B2B fintech traction.

💰 Profitability Turning the Corner:

First Full-Year GAAP Profitability: $499M (includes tax benefits), with ~18.7% GAAP net margin.

Adjusted Net Income: $227M (excluding one-time benefits).

Operating Leverage: Adjusted EBITDA margin expanded from 21% (2023) → 26% (2024), as marketing & tech costs scaled better.

Cost Discipline: Marketing spend remains high (~$720M in 2023) but is falling as % of revenue.

🏦 Strong Balance Sheet & Liquidity:

Tangible Book Value: $4.9B, growing steadily.

Debt-to-Equity Ratio: A reasonable 0.5x (excluding deposits).

Deposits Surged to $25B+, providing cheap funding (~90% direct deposit customers).

97% of deposits FDIC-insured, mitigating bank run risks.

SoFi’s financial flywheel is now self-sustaining—as deposits grow, loan funding costs decline, margins improve, and more cash flows into growth initiatives.

🌍 Competition & Industry Growth: A Fiercely Competitive Market (Score: 7/10)

🔹 Who Does SoFi Compete With?

SoFi sits at the intersection of traditional banking, fintech lending, and digital investing, meaning it faces competition from multiple categories:

🏦 Big Banks (Chase, Wells Fargo, Bank of America) – Traditional banks offer full-service financial products but often lack modern digital experiences. They have deep pockets but move slowly.

📱 Neobanks (Chime, Revolut, N26) – Neobanks focus on digital-first banking but lack the lending capabilities and product depth that SoFi has.

💳 Fintech Lenders (Upstart, LendingClub, Affirm) – These companies compete with SoFi’s personal loan and student loan refinance businesses but lack a bank charter (a key advantage for SoFi).

📊 Investment Platforms (Robinhood, Fidelity, Charles Schwab) – SoFi Invest competes in the brokerage space but remains a smaller player compared to these giants.

🔹 Growth Opportunities in the Industry

✅ Digital Banking Adoption is Rising – Younger generations prefer managing their finances digitally, which aligns well with SoFi’s mobile-first approach.

✅ Banking Consolidation – Many fintechs struggle to survive as standalone entities; SoFi’s integrated approach makes it more resilient.

✅ Embedded Finance & B2B Banking-as-a-Service – Galileo & Technisys position SoFi to benefit from banks and fintechs modernizing their tech stacks.

SoFi has a strong position, but competition is fierce, requiring constant innovation.

🛡 Competitive Moat: What Gives SoFi an Edge? (Score: 8/10)

🔹 The Bank Charter: SoFi’s Ultimate Competitive Edge

The biggest moat SoFi has is its bank charter—a rare asset in the fintech world. Unlike competitors who rely on third-party banks to hold deposits or fund loans, SoFi directly controls its own banking operations. This gives it two massive advantages:

1️⃣ Cheaper Loan Funding – By using its growing base of customer deposits (~$25B), SoFi funds its personal and student loans at a much lower cost than fintech lenders who borrow at higher rates.

2️⃣ Higher Net Interest Margins (NIM) – Traditional fintech lenders (e.g., Upstart, LendingClub) don’t have the ability to earn spreads on deposits. SoFi, on the other hand, generates consistent, high-margin revenue from deposit-fueled lending.

🔹 Other Key Moats:

✔️ B2B Tech Platform (Galileo & Technisys) – SoFi owns banking infrastructure technology that it sells to other fintechs, allowing it to earn revenue even from competitors.

✔️ High-Quality Customer Base – SoFi’s members have higher FICO scores (~749 median), meaning lower loan default rates compared to typical fintech lenders.

👨💼 Management & Execution: A Strong Leadership Team with Proven Execution (Score: 8/10)

🔹 Anthony Noto: A Leader with Strategic Clarity

SoFi’s CEO, Anthony Noto, has been the driving force behind the company’s evolution into a full-fledged financial institution. With a background as Twitter’s CFO and a former MD at Goldman Sachs, Noto brings deep experience in both tech and finance. His leadership has been instrumental in navigating SoFi through significant expansions, including acquiring a bank charter, diversifying revenue streams, and achieving GAAP profitability—something that many fintechs have struggled to do.

🔹 Key Strengths of SoFi’s Management Team

✔️ Clear Strategic Vision – The team has consistently articulated a long-term vision of SoFi as a next-gen financial institution. Unlike many fintechs that focus on a single vertical, SoFi’s leadership has pushed an integrated model that enhances cross-selling and retention.

✔️ Strong Risk Management – SoFi has maintained conservative underwriting standards (e.g., personal loan borrowers have a median FICO score of ~749) to avoid the pitfalls of subprime lending that plagued fintech competitors.

✔️ Ability to Adapt & Pivot – The company pivoted effectively when the student loan moratorium hurt its core business in 2020-2023, scaling personal loans and financial services instead.

✔️ Marketing & Branding Excellence – The SoFi Stadium deal and other marketing initiatives have built strong brand recognition.

⚠️ Challenges Going Forward

❌ Sustaining Profitability at Scale – While SoFi is now profitable, maintaining high margins as competition increases will be a challenge.

❌ Balancing Growth & Efficiency – The company has historically spent heavily on marketing (~$720M in 2023). Scaling back while maintaining growth will require precise execution.

❌ Retention & Cross-Sell Challenges – SoFi’s ability to deepen engagement with customers (beyond just one or two products) is crucial for long-term success.

Overall, SoFi’s management has executed exceptionally well so far, but they must prove they can sustain profitable growth at scale in a highly competitive fintech environment.

🚨 Risks to Watch: Key Headwinds Facing SoFi (Score: 6/10)

🔹 1️⃣ Credit & Loan Default Risk

If the economy weakens, loan defaults could rise, impacting SoFi’s profitability. However, SoFi’s high-FICO borrower base (~749 median score) offers some protection.

🔹 2️⃣ Regulatory Risk & Compliance Costs

As a bank holding company, SoFi faces tighter regulatory scrutiny than most fintechs. Any new regulations (e.g., capital requirements, fintech lending rules) could impact profitability.

🔹 3️⃣ Profitability vs. Growth Tradeoff

SoFi is now profitable, but balancing aggressive expansion with cost discipline remains a challenge. Cutting too much could slow growth, while overspending could erode profitability.

SoFi’s risk profile is manageable, but execution will be key to navigating these challenges.

🔭 Where Will SoFi Be in 5 Years?

SoFi has strong potential to grow if management executes well:

📌 Member Growth: 20M+ members (up from 10.1M in 2024), driven by organic growth & cross-selling.

📌 Revenue: $5B+ annual revenue (assuming ~20% CAGR growth).

📌 Profitability: GAAP net income of $1B+, with net margins stabilizing at 18-20%.

📌 Market Cap: $30B+ valuation, reflecting a 2x-3x upside from today’s price.

📌 B2B Expansion: Galileo & Technisys powering hundreds of fintechs globally.

📌 Wealth & Investing Growth: SoFi Invest becoming a major stock & wealth management platform.

If SoFi continues executing well, it could become a top 10 financial institution in the U.S., combining the digital-first strengths of a fintech with the stability and lending power of a traditional bank.

📊 Valuation: Is SoFi a Buy? (Score: 7/10)

SoFi’s stock currently trades at ~$11–12 per share, with a market capitalization of $13–15 billion. It’s priced at ~5x sales and ~2.8x tangible book value, which is higher than traditional banks but in line with other high-growth fintechs. The stock is not a deep bargain but offers reasonable upside if execution remains strong.

📈 Base Case ($14–15/share): Steady Growth with Expanding Margins

If SoFi maintains ~20% annual revenue growth, expands margins, and scales lending and banking efficiently, it should trade at 4-5x revenue as profitability improves. This would result in a moderate upside to $14–15 per share over the next 12–18 months, assuming stable market conditions.

🚀 Bull Case ($20+ share): Faster Expansion & Higher Market Share

If SoFi grows faster than expected, especially in B2B tech (Galileo, Technisys), and strengthens its financial services adoption, it could achieve 6x+ sales valuation. Stronger margins and deeper user engagement could push the stock above $20 per share over time.

🐻 Bear Case ($6–8/share): Slower Growth or Market Headwinds

If loan defaults increase, regulatory pressure intensifies, or demand for lending weakens due to economic conditions, SoFi’s valuation could drop to 2-3x revenue, leading to a stock price of $6–8 per share—in line with past fintech downturns.

💡 Final Verdict: Buy for Long-Term, Expect Volatility

SoFi has proven its ability to scale, achieve profitability, and compete effectively in a crowded fintech landscape. Its bank charter remains its strongest competitive advantage, allowing it to offer products most fintechs cannot while maintaining lower funding costs. The growth of its B2B tech platform and financial services ecosystem presents additional upside opportunities.

However, execution risks, regulatory scrutiny, and macroeconomic headwinds remain key challenges. Investors should be prepared for volatility, as fintech valuations can fluctuate significantly based on broader market sentiment.

For long-term investors, SoFi presents a compelling growth opportunity with strong upside potential over the next five years. If the company continues to execute well, it could emerge as one of the leading financial institutions of the digital age, offering 2x-3x upside from today’s price.